The Challenge

A financial company specializing in personal loans aimed to assist individuals struggling with debt. The challenge was to craft an ad that could lower the cost per acquisition (CPA) while maximizing the amount of debt enrolled through their loan programs. The CPA was calculated by dividing the total amount of debt acquired by the total ad spend and expressed as a percentage. The goal was to create a simple yet impactful image ad to drive significant engagement and conversions.

The Creative Journey

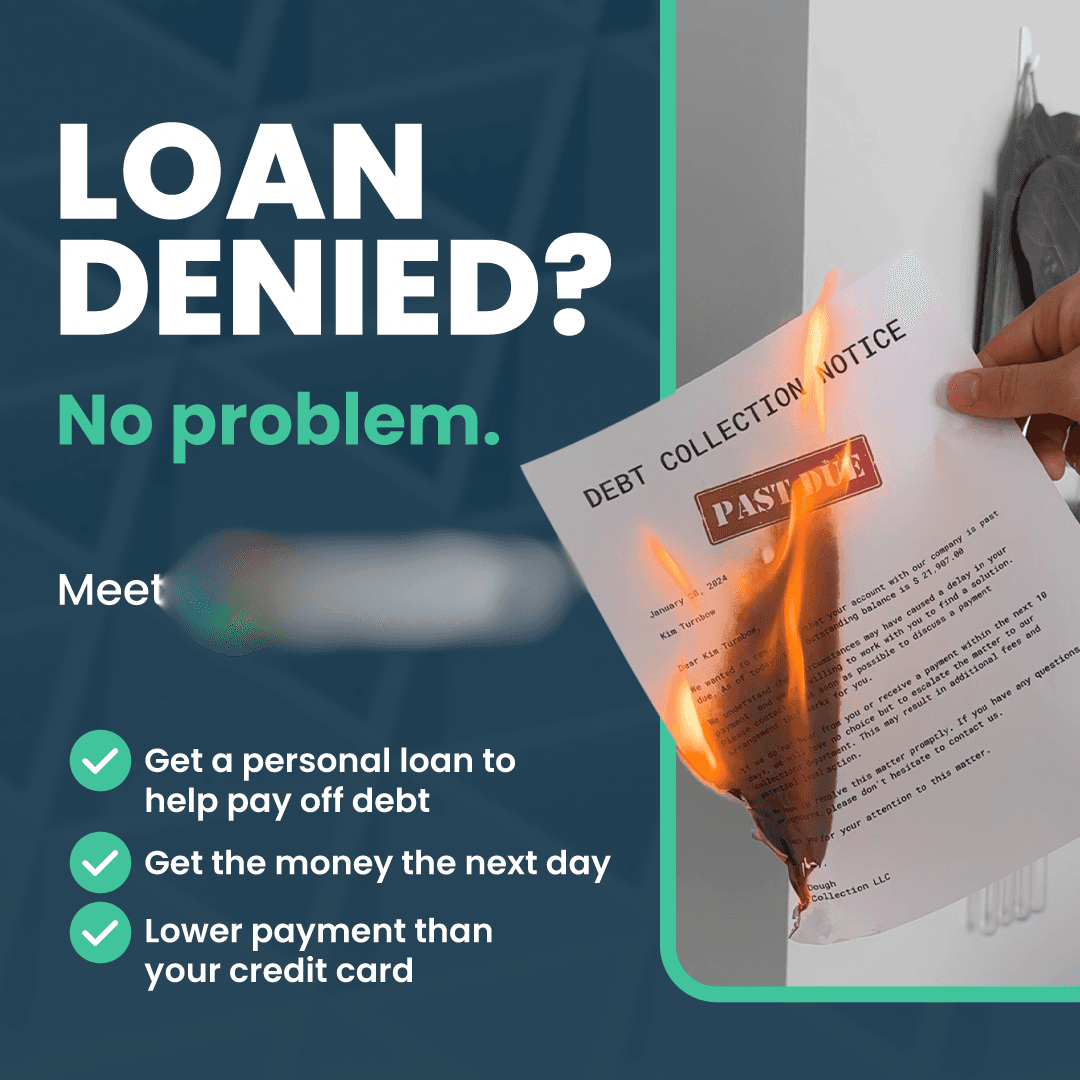

To tackle this challenge, we developed the "Loan Denied? No Problem." ad campaign. The concept was straightforward yet powerful: a debt collection notice being burned, symbolizing the end of debt worries. The headline, "Loan Denied? No problem," directly addressed a common pain point, offering a lifeline through the financial services provided.

The ad highlighted three key benefits:

Get a personal loan to help pay off debt

Get the money the next day

Lower payments than credit cards

This clear and concise messaging, paired with a strong visual element, created a sense of urgency and hope for the audience.

Ad Design and Messaging

The ad image featured:

A striking visual: A debt collection notice being set aflame, symbolizing liberation from debt.

A bold headline: "Loan Denied? No problem," instantly capturing attention.

Key benefits: Listed clearly, reinforcing the advantages of the service.

The accompanying social media post elaborated on the benefits, making the process seem quick, easy, and advantageous:

"A personal loan designed to help pay off credit cards and simplify life"

"Check rates in 1 minute, accept the terms online, and get money the next day"

"Lower monthly interest rates than credit cards"

Campaign Insights and Impact

This campaign was particularly meaningful to me because of my personal experience with family members who have faced major debt. Understanding their pain points and the stress that comes from receiving debt collection notices inspired me to create this ad.

The "Loan Denied? No Problem." campaign achieved significant engagement and a noteworthy reduction in the cost per acquisition, while successfully enrolling a considerable amount of debt through the loan programs. The clear messaging and impactful visuals resonated deeply with the target audience, driving meaningful conversions.

By using customer-centric research and focusing on the emotional impact of debt, I aimed to create an ad that resonated deeply with viewers. The image of a burning debt collection notice was both symbolic and emotionally powerful, capturing attention and evoking a sense of relief. By addressing the audience's pain points directly and offering a straightforward solution, the ad drove significant engagement and conversions.

This case study exemplifies how a well-crafted image ad can achieve substantial business results. It highlights the importance of clear messaging, impactful visuals, and addressing audience pain points in driving successful marketing campaigns. By putting the customer first and understanding their emotional journey, we can create campaigns that truly resonate and deliver exceptional results.

*Note: Due to confidentiality agreements, specific company data and names have been omitted.